It can be painful to watch a share for which one has great hopes crash and burn. But a growth share that saw its share price rise rapidly several years ago matches that description.

I own it and looking at the current share price makes me wince. However, I think there may be substantial value in the business that the stock market is overlooking.

Some recent news may be a catalyst for the growth share to start gaining momentum again, in my view.

Digital ad agency network with strong growth history

The share in question is S4 Capital (LSE: SFOR). It grew quickly by acquiring a range of digital ad agencies and has a powerful product offering that has attracted world-class clients.

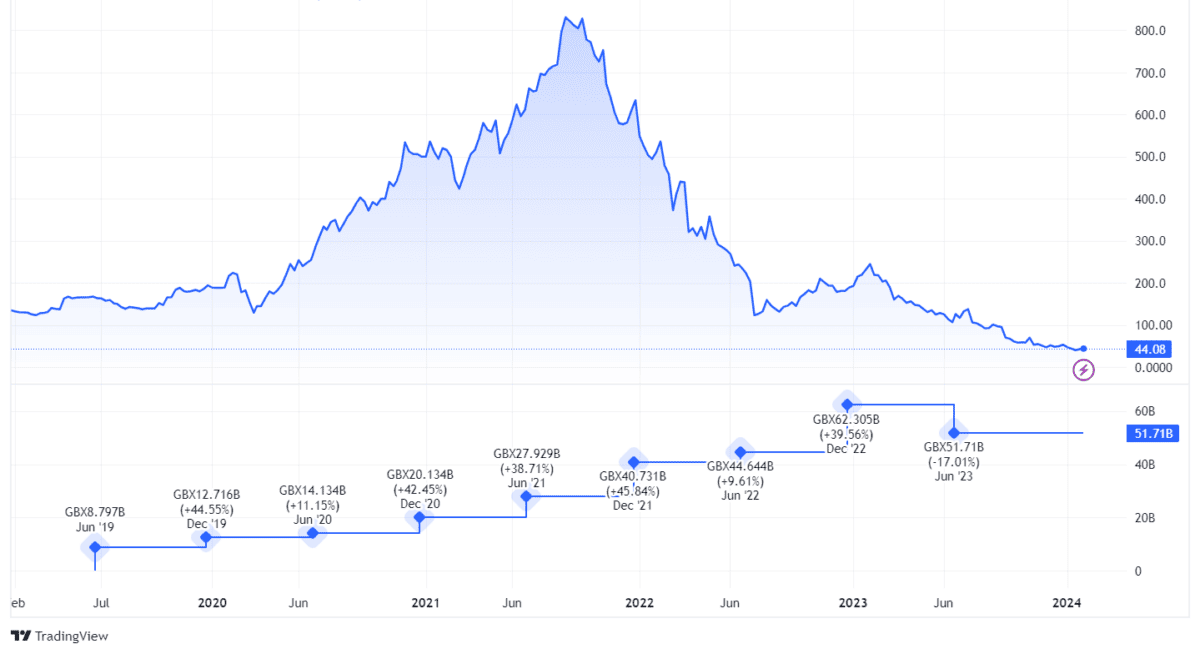

Its share price has collapsed. The growth share is worth just a fifth of what it was a year ago. But while the share price has been in freefall, there is a strong history of revenue growth at the business.

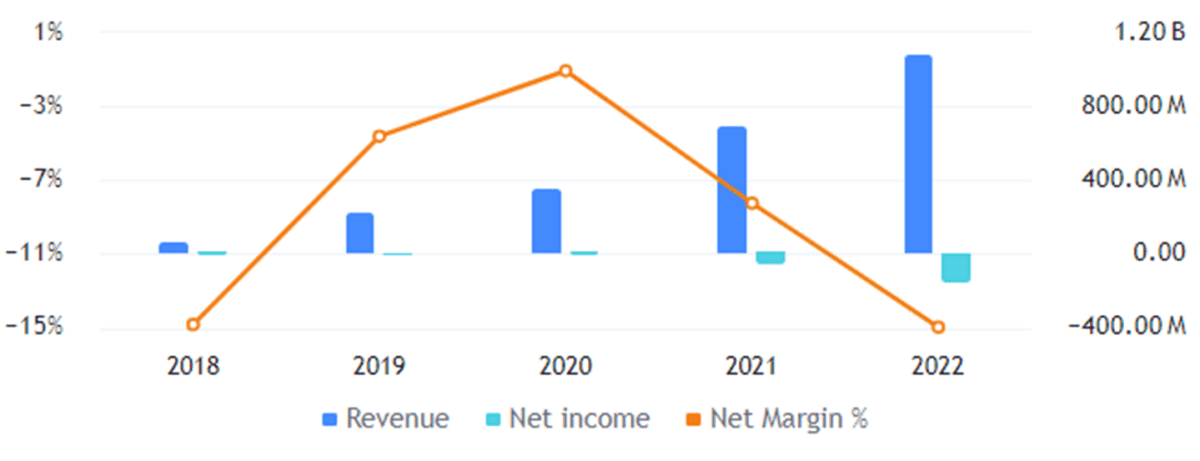

That has not been maintained and the company expects its full-year results to show a revenue decline from the previous year. A weak advertising market risks further falls.

But that also reflects S4’s evolving nature. It has stopped acquisitions for now and is focusing on improving its financial performance and profit margins.

I think that bodes well. After all, its revenues in the latest quarter were roughly a quarter of a billion pounds. That is almost the same as its market capitalisation of £255m.

Focus on earnings and debt

But revenues are one thing. The bigger concern many investors have about S4 is its profitability and balance sheet.

It is loss-making, although the loss per share in the first half of 3.2p was sharply lower than in the same period last year. With an ongoing focus on cost control I am hoping the company can return to the position of several years ago when it was profitable.

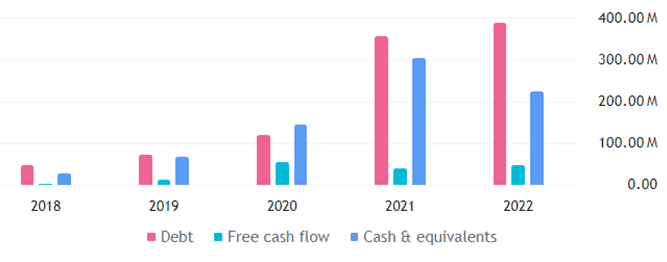

Another concern is net debt. It has risen steeply over the past few years, largely due to the acquisition streak.

The company ended its most recent quarter with net debt of £185m. But it noted that, “the balance sheet has sufficient liquidity and long-dated debt maturities to facilitate growth”.

This week, S4 started a share buyback. The scale is small, with a total maximum in this round of under £3m. But I still take it as a positive sign that the board is comfortable enough with the debt position to spend cash buying back shares.

Light at the end of the tunnel?

There are still clear risks here.

However, I think there are positive signs that could potentially support the growth share rising from here.

One is the optimism signalled by the buyback. Another was a fourth-quarter trading statement this week that contained various reassuring items, such as that operational earnings margin before interest, tax, depreciation, and amortisation improved in the second half of last year due to cost control.

S4 has disappointed me badly before. But I see the current price of the growth share as low given its long-term potential, so I plan to hold my shares.